This paper, part of the SNHU MBA 620 Milestone Two Assignment, provides an extensive analysis of TransGlobal Airlines, focusing on key aspects such as organizational culture, financial performance, and market analysis for the purpose of determining whether TransGlobal Airlines should acquire either Company A or Company B. The paper evaluates the potential for an acquisition using a balanced scorecard approach to measure performance in various areas. A detailed comparison between Companies A and B examines their compatibility with TransGlobal Airlines in terms of finances, strategy, and operational synergy. The report highlights the costs, benefits, risks, and overall fit of each company to guide decision-making for the airline’s acquisition target. The recommendation section emphasizes the need for thorough due diligence in strategic decision-making for acquisitions. It stresses the importance of considering strategic, financial, and cultural factors when evaluating potential companies for acquisition. While not disclosing specific findings, this document provides a comprehensive framework for effective decision-making in corporate acquisitions tailored to the air transport industry.

Purchase this full paper for $20.

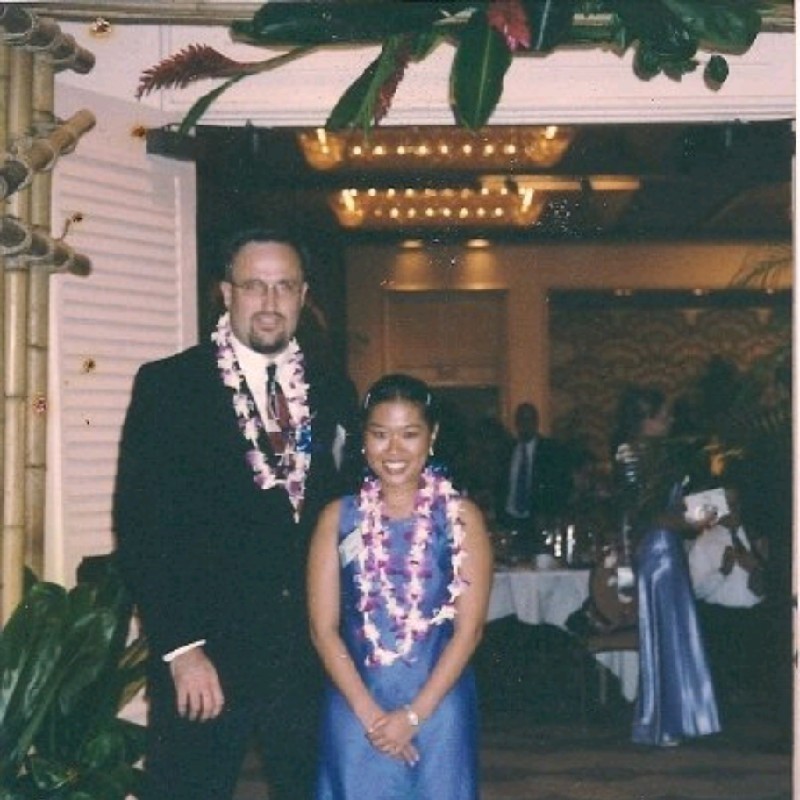

Nick, Founder & CEO of Wiener Squad Media

Nick is the visionary founder and CEO of Wiener Squad Media, based in Orlando, FL, where he passionately supports Republican, Libertarian, and other conservative entrepreneurs in building and growing their businesses through effective website design and digital marketing strategies. With a strong background in marketing, Nick previously ran a successful marketing agency for 15 years that achieved seven-figure revenue before an unfortunate acquisition led to its closure. This experience fueled his resolve to create Wiener Squad Media, driven by a mission to provide outstanding digital marketing services tailored specifically for conservative-owned small businesses.

Holding a Master of Science in Marketing from Hawaii Pacific University (2003), Nick is currently furthering his education with an MBA to enhance his problem-solving skills and ensure that past challenges don’t repeat themselves. He firmly believes in the marathon approach to business growth, prioritizing sustainable practices over quick fixes like investor capital. Committed to employee welfare, Nick maintains a starting wage of $25 per hour for his staff and caps his own salary at $80,000 plus bonuses.

At Wiener Squad Media, our values are based on the Five Pillars of Giving – protecting the First and Second Amendments, Sanctity of Life, supporting our military, veteran, and first responder heroes, and making sure no shelter dog is left behind by finding each one a forever home. At Wiener Squad Media, we are not just about success but also about making a positive impact on society while achieving it.

Outside of work, Nick is an avid political activist who engages in discussions supporting conservative values. He volunteers at local animal shelters, participates in pet adoption events to help find all unwanted dogs a forever home. Committed to nurturing the next generation of entrepreneurs, Nick dedicates time to coaching and mentoring other aspiring conservative business owners, sharing his wealth of knowledge and experience in the industry.